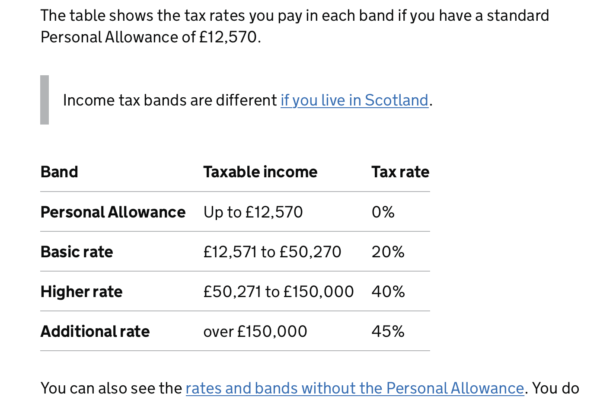

If I were to work Freelance in the UK, I would have to pay my own taxes as a Sole Trader. I would also have to pay National insurance contributions. The 2021-22 tax year contributions are as follows:

Anything up to £12,570 isn’t taxed,

anything earned between £12,571 to £50,270 gets taxed 20%,

between £50,271 to £150,000 is taxed 40%

and anything above that is taxed 45%.

Source from the government website: https://www.gov.uk/income-tax-rates

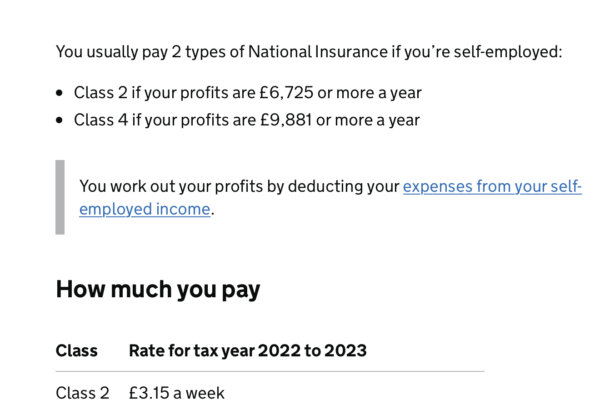

National insurance is worked out with 2 classes. Class 2 if your profits are more than £6,725 a year, in which you pay £3.15 a week, or Class 4 if your profits are more than £9,881 a year, in which you pay 10.25% on profits between £9,881 and £50,270, and 3.25% on profits over that amount.

Source from the government website: https://www.gov.uk/self-employed-national-insurance-rates